100%

Satisfaction

Guaranteed

We build standout digital experiences that will convert your visitors to clients.

Satisfaction

Guaranteed

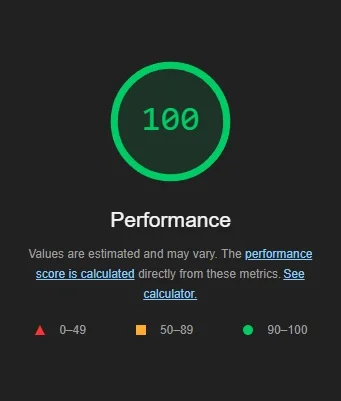

Page Speed

Scores

Google

Reviews

When it comes to website load times, not very many can get the Google PageSpeed scores that we get with each and every site. Test your website load times with Google PageSpeed Insights and see what your current site is scoring right now.

Better load times means more traffic and more site conversions over time.

Faster websites can help improve SEO and your Google ads performance.

Our sites load instantly in under 1 second or less, which leads to a better user experience and conversions.

Unlock the power of AI to streamline operations and enhance customer experiences.

We create custom mobile apps tailored to your business, delivering seamless experiences on any platform.

Build an online store that drives sales with secure, scalable, and user-friendly ecommerce platforms.

Elevate your brand with cohesive designs and strategies that make a lasting impression.

Boost your online visibility and attract more customers with our tailored SEO strategies.

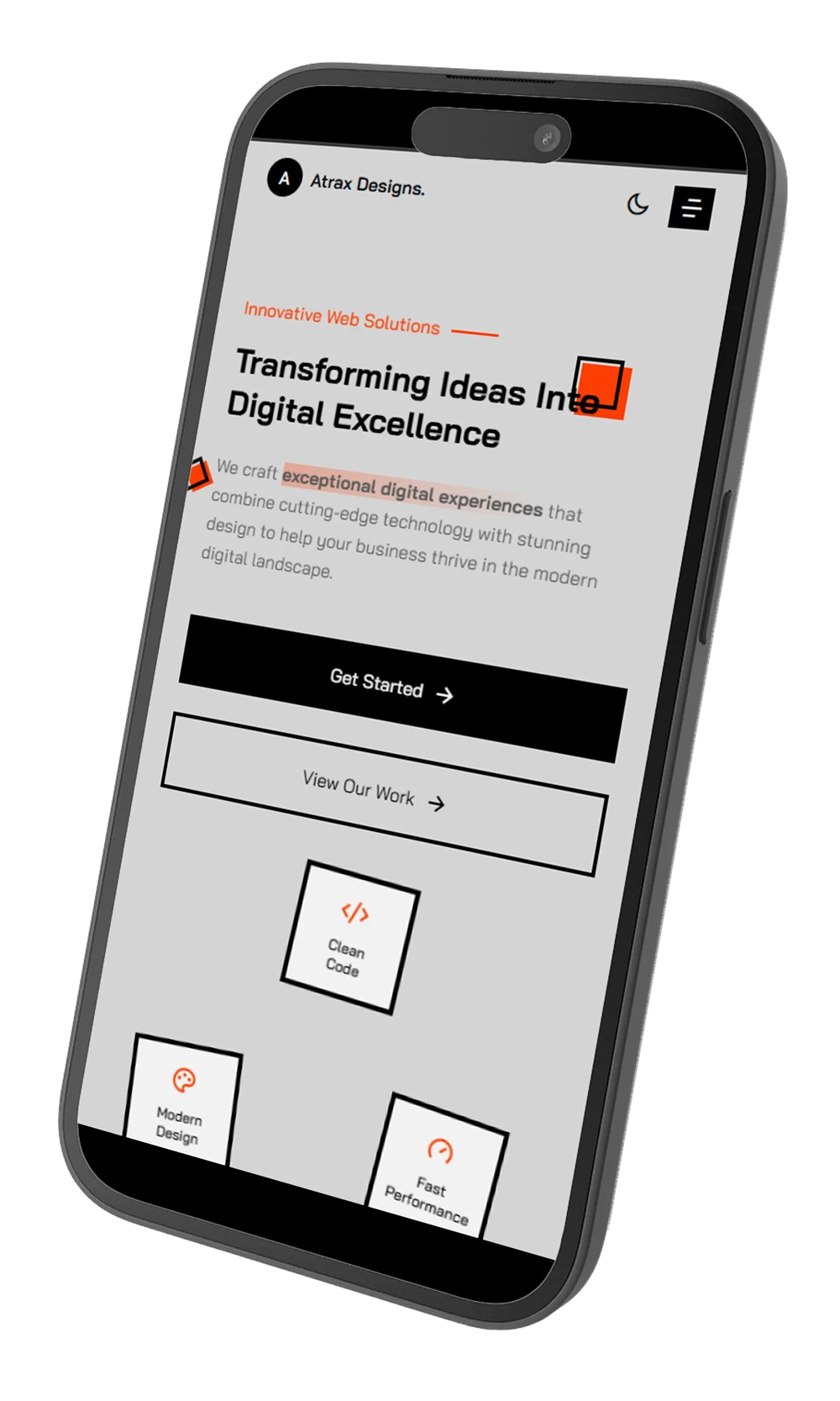

We design and develop responsive, high-performance websites that engage and convert visitors into clients.

Partner with a web design agency that puts your success first. We combine creative expertise with technical excellence to deliver websites that drive real business results.

Every website is built from scratch to match your unique brand and requirements. No templates, just pure custom code.

Get your website up and running in weeks, not months. We prioritize efficiency without compromising quality.

Professional web development at affordable rates. Choose between one-time payment or monthly plans.

We don't disappear after launch. Get reliable support and maintenance to keep your site running smoothly.

We have worked with clients across various industries.

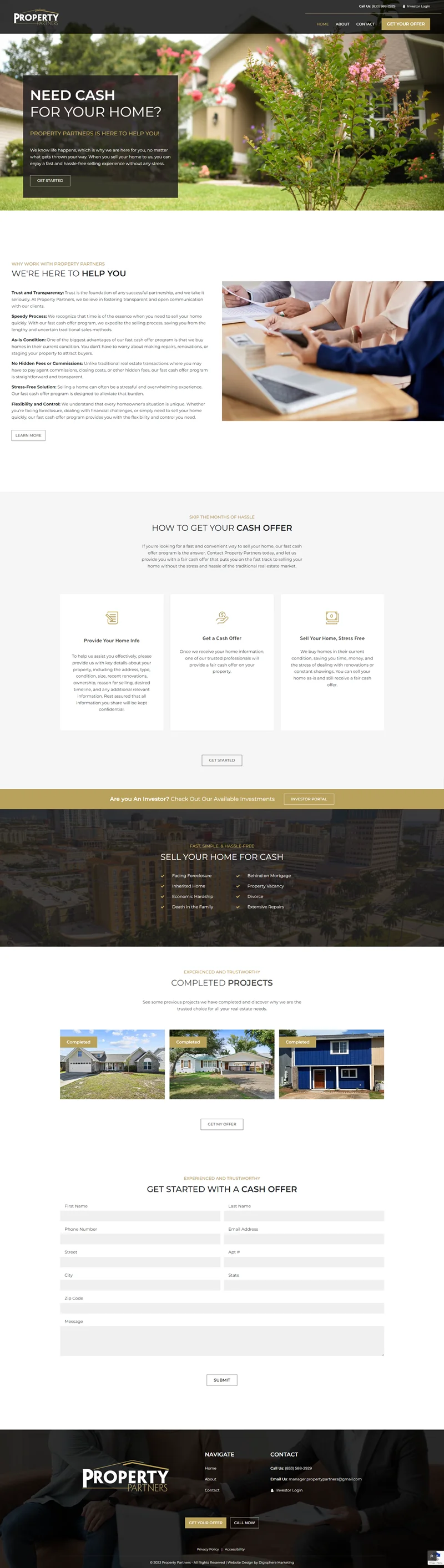

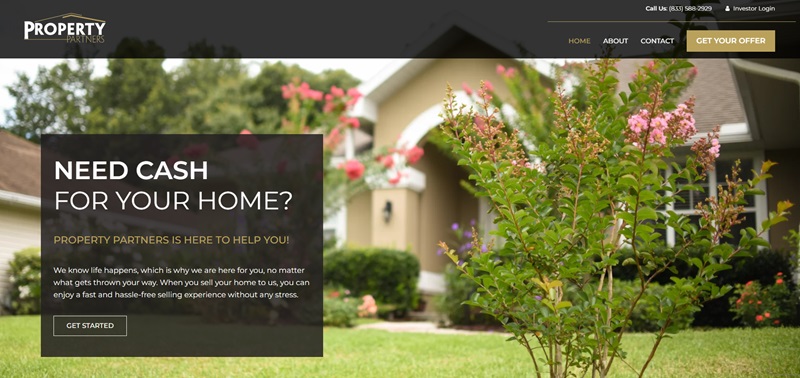

Developed a custom website for a real estate company, with a property database, user login, authentication and appointment scheduling.

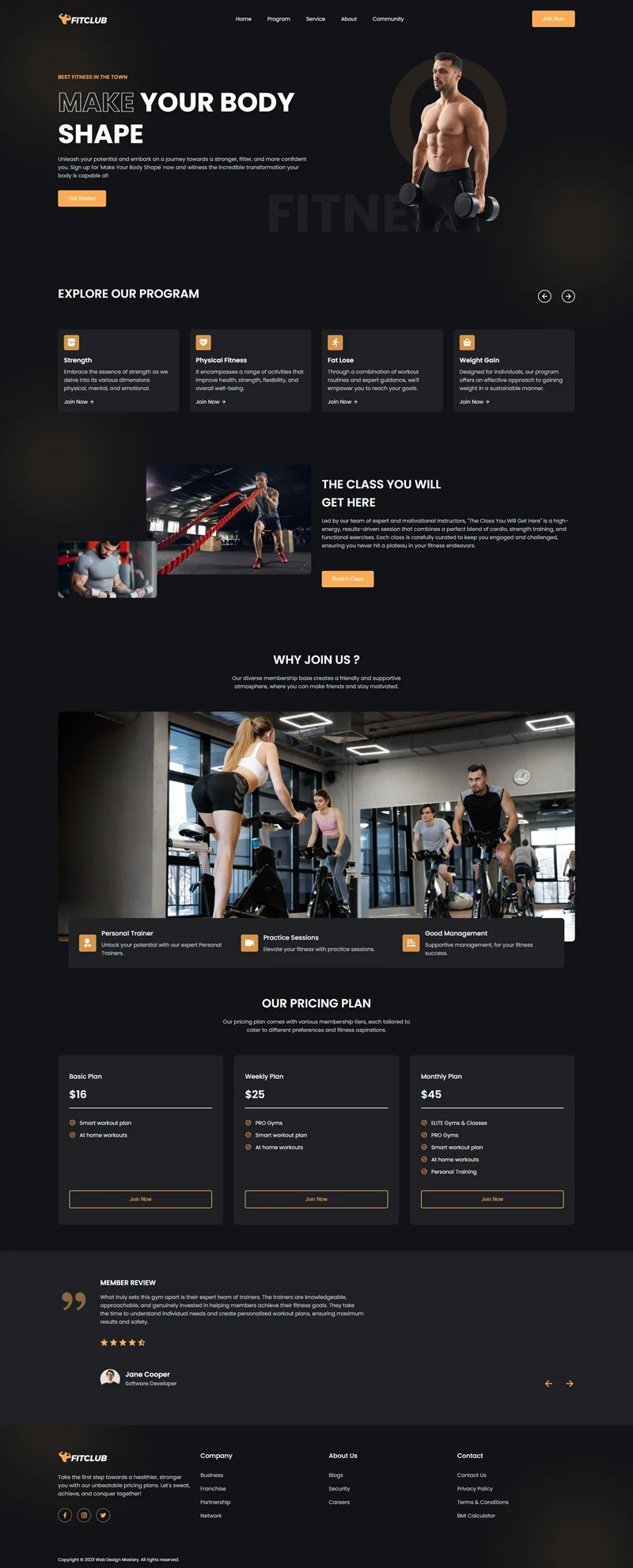

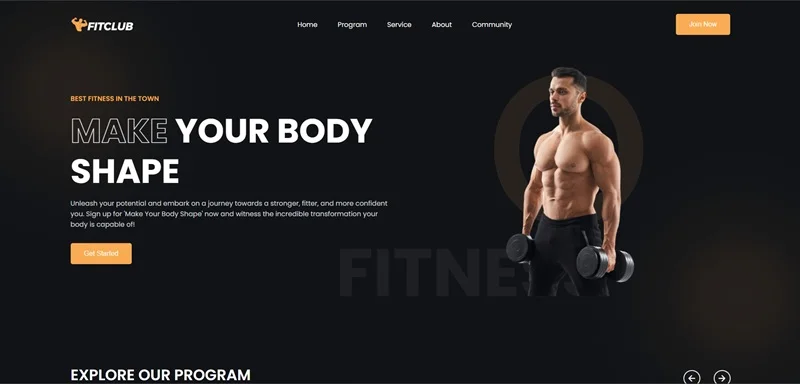

Developed a custom website for a fitness influencer and gym trainer.

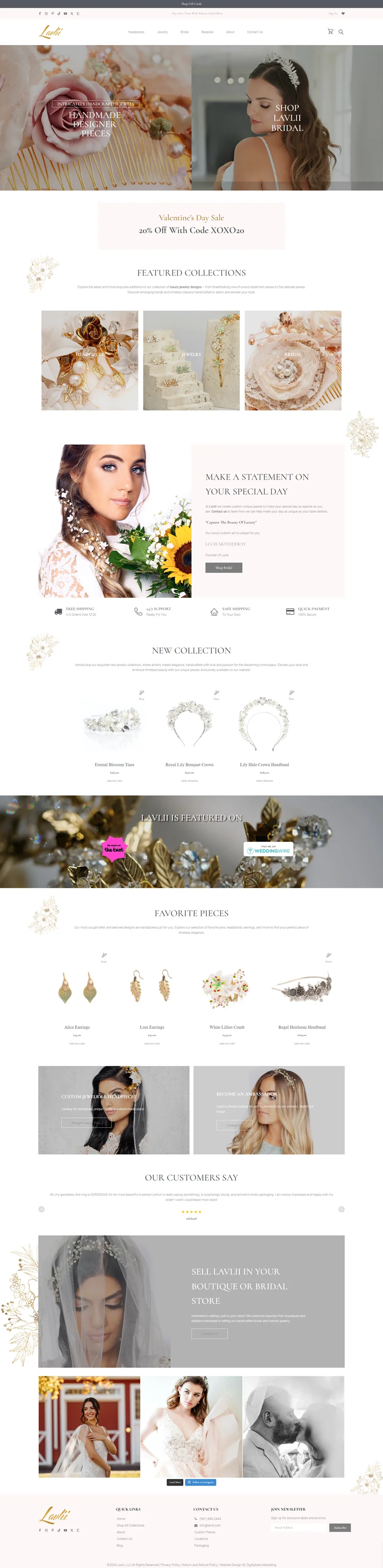

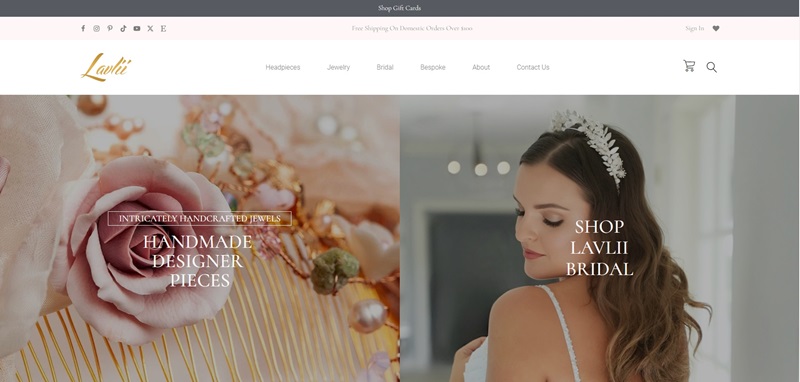

Designed and developed a custom website for a high-end bespoke luxury jewelry maker.

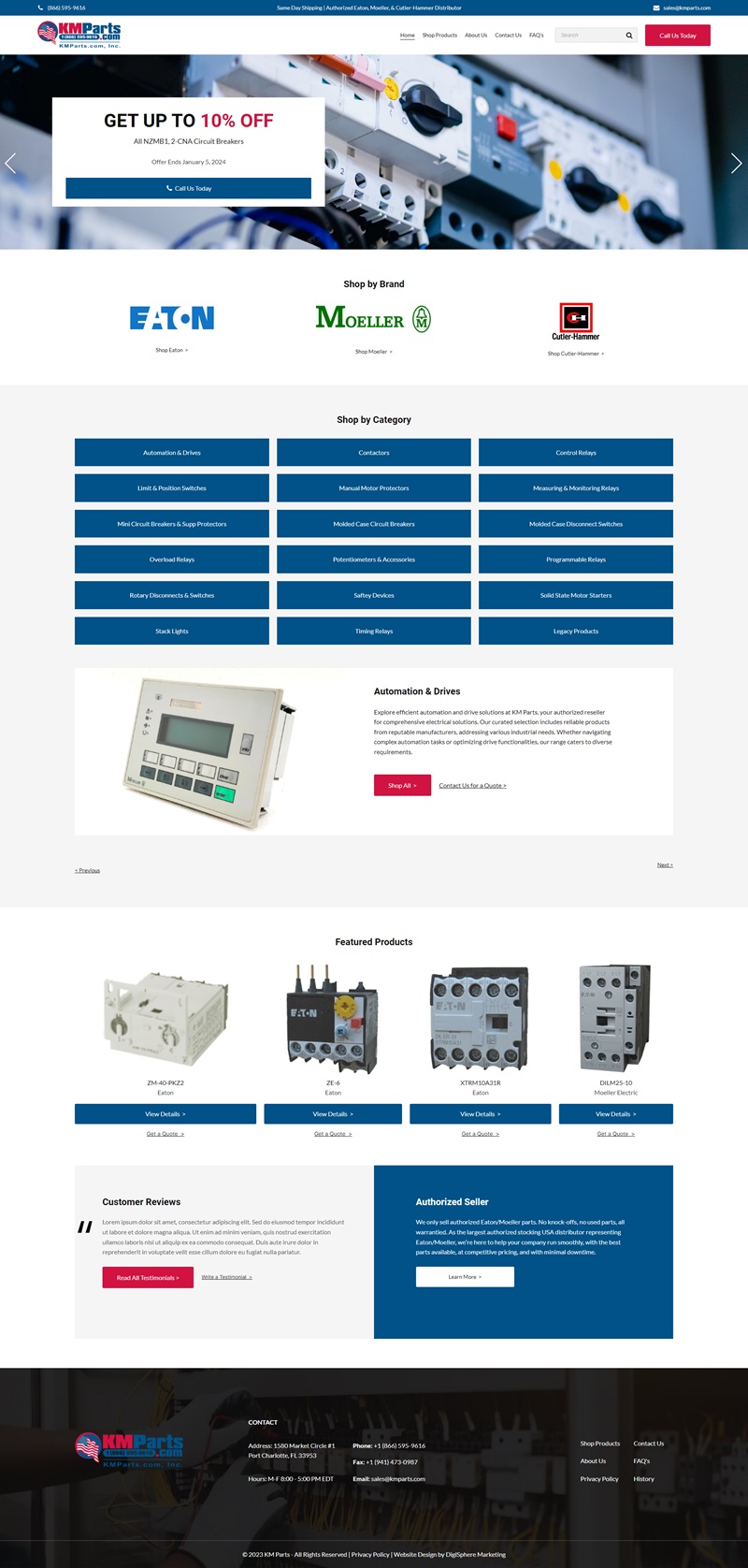

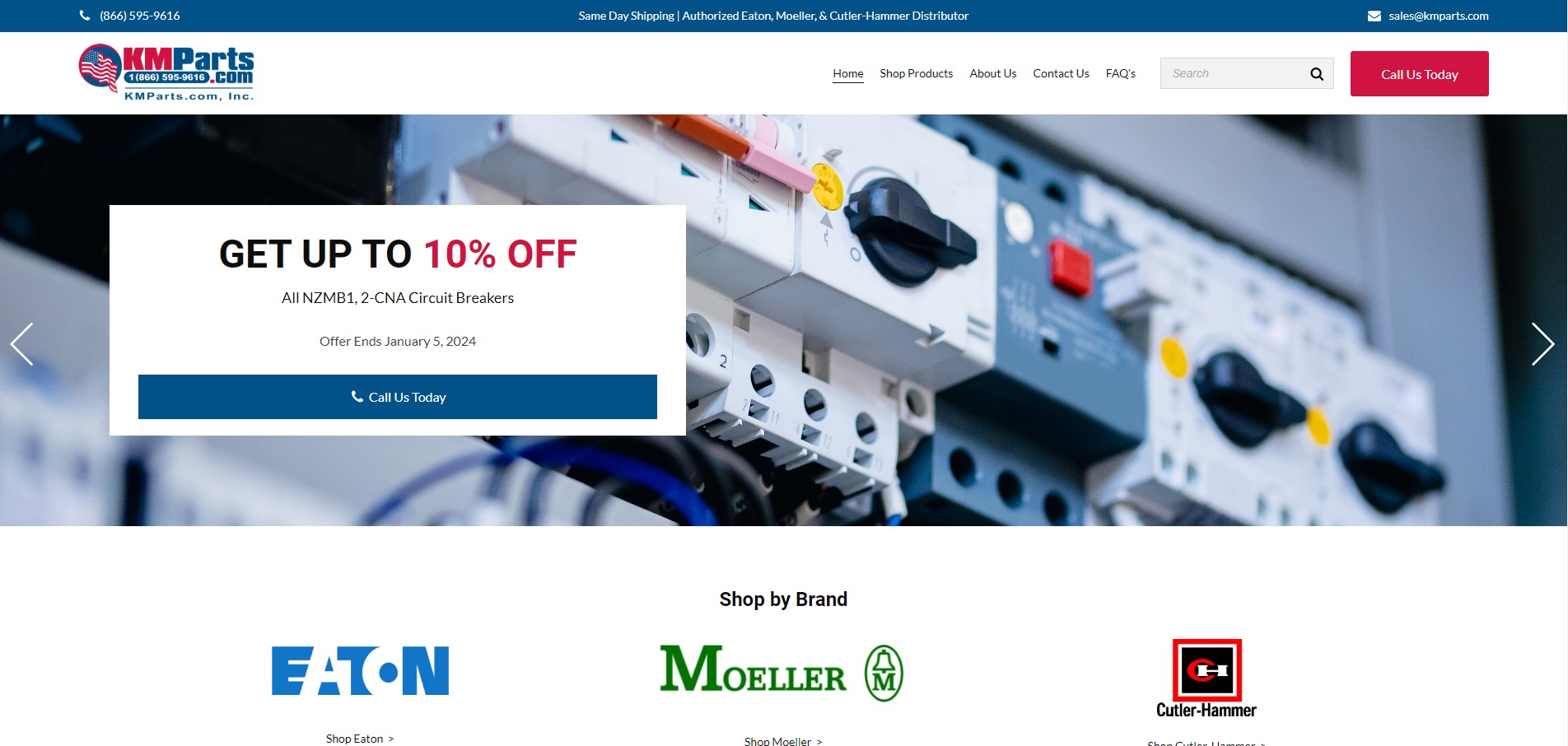

Developed a custom website with ecommerce, for a leader in the industrial automation space.

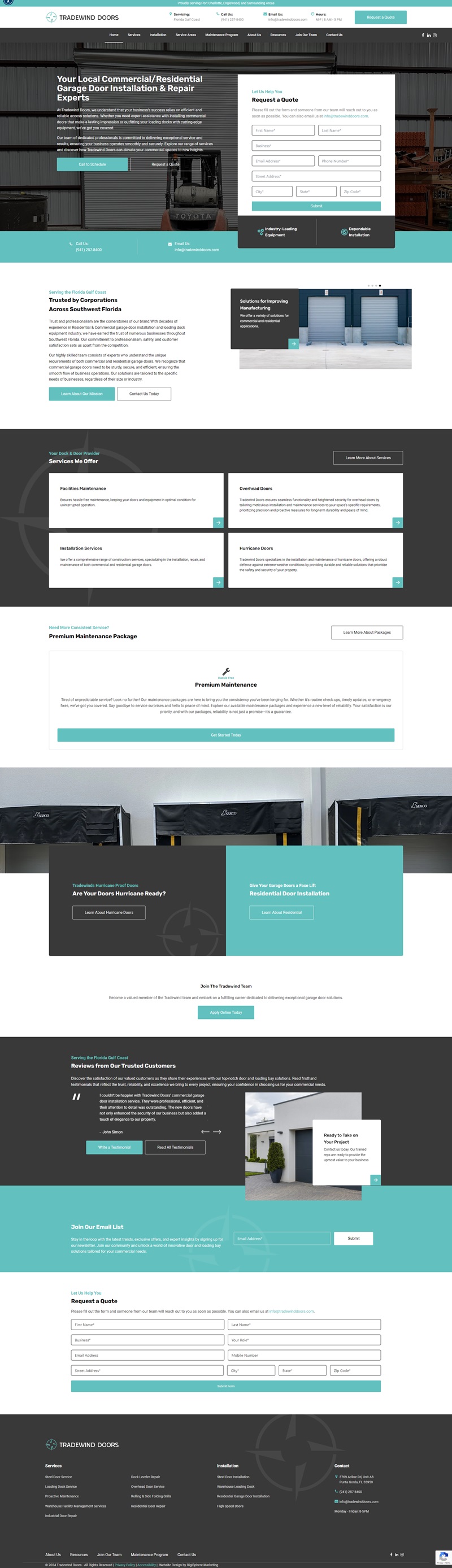

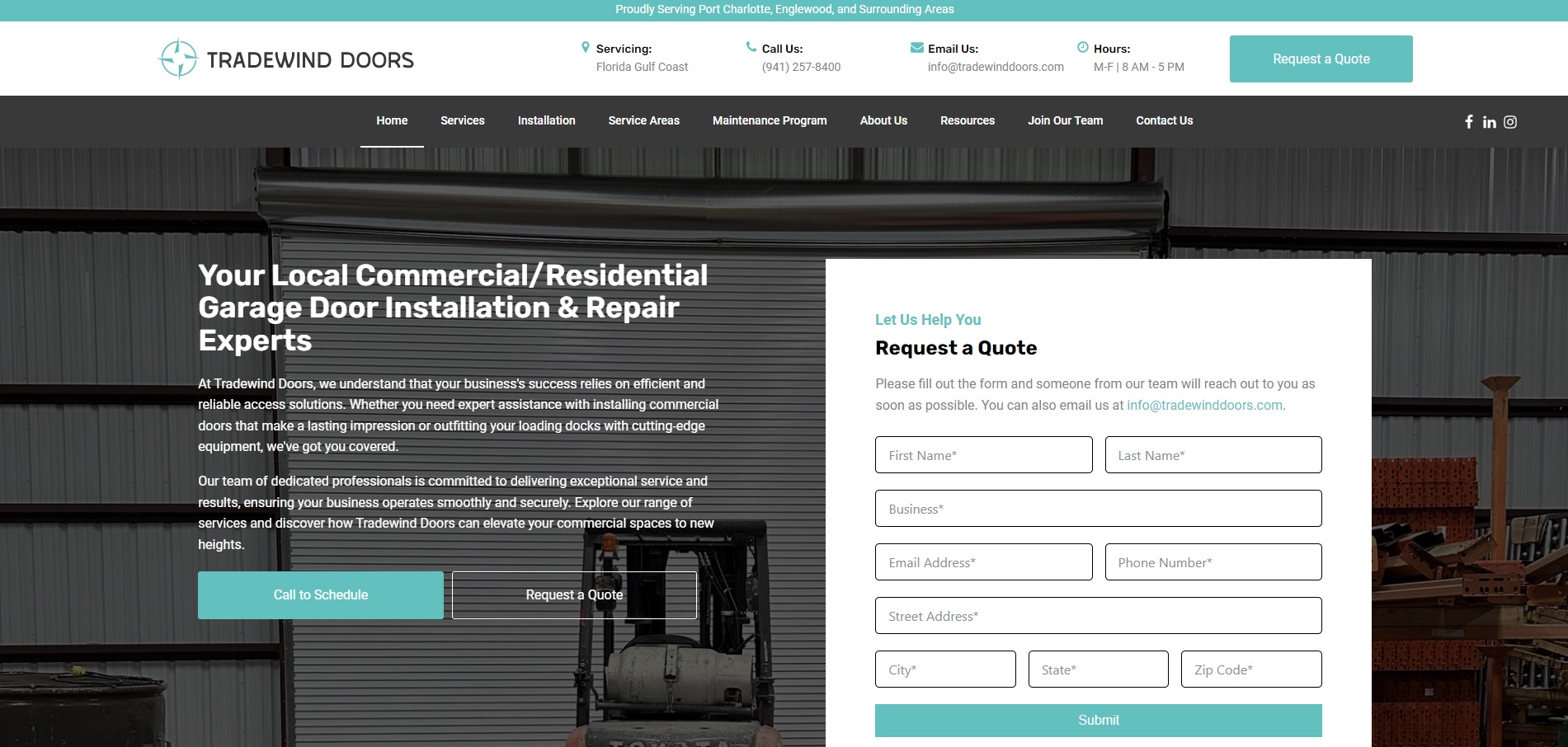

Developed a website for a local residential and commercial installation company, that specalises in installing doors.

One-time Payment

Flexible Payments

Online Store

Transform your ideas into reality with our expert team of designers and developers

I've crafted a bespoke static website using pure html and css for a fitness influencer and gym trainer.

I've crafted a bespoke website for a real estate company, featuring a sophisticated property database, secure user login and authentication, alongside a streamlined appointment scheduling system. This project was designed to enhance the user experience by providing easy access to property listings, ensuring secure transactions, and simplifying the process of scheduling viewings, all within a seamless and interactive platform.

I meticulously designed and developed a custom website for a high-end bespoke luxury jewelry maker, focusing on capturing the essence of their craftsmanship and the exclusivity of their pieces. This project involved creating an elegant and sophisticated online showcase, enabling vivid displays of their jewelry collections and facilitating a personalized shopping experience for discerning clients.

I developed a custom e-commerce website for a leading company in the industrial automation sector, designed to showcase their cutting-edge products and solutions. This project entailed building a robust online platform that combines an intuitive shopping experience with detailed product information, facilitating seamless transactions for customers seeking advanced automation technologies.

I created a website for a local company specializing in residential and commercial door installations, aimed at showcasing their expertise and range of services. This project involved designing an informative platform that highlights the company's specialization in door installation, providing detailed descriptions of their services, and offering a user-friendly interface for potential clients to easily get in touch and request quotes.